The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

Author

Saty AvagyanSource

AFMTopic

Deposits, AMIO Bank, Araratbank, ArmSwissBank, Byblos Bank Armenia, Evocabank, Inecobank, Converse Bank, Armeconombank, Unibank

As of January 2026, the most competitive one-year fixed-term deposits in Armenia offer interest rates of up to 10% in AMD, 5% in USD, and 2.5% in EUR. Byblos Bank Armenia, AMIO Bank, and Artsakhbank remain the market leaders for AMD deposit yields, while AMIO Bank offers the top rates for USD deposits, and Araratbank leads for those in EUR.

Why a 1-Year Term Was Chosen for Comparison

Armenian banks offer deposits with longer maturities; however, for the purposes of this comparison, a 1-year term was selected as a standard and comparable benchmark. One-year deposits are most commonly used by clients for an initial placement of funds, as they provide a balance between yield and flexibility. This term allows depositors to reassess their strategy after a relatively short period and enables an objective comparison of bank offers without long-term commitments.

All the deposits listed are available under standard placement conditions and represent some of the highest interest rates on the Armenian market for a one-year term. They are suitable for placing amounts of around 10 million Armenian drams or an equivalent sum in US dollars or euros.

Top 1-Year Deposits in Armenia – Quick Comparison

Armenian Dram Deposits (AMD)

| Bank | Deposit Type | Rate | Term | Interest Payment | Min / Max Amount |

| Byblos Bank Armenia | Term Deposit | 10% | 365 days | At maturity | AMD 1,000,000 – 300,000,000 |

| AMIO Bank | "Profitable" Term Deposit via AMIO Mobile | 10% | 366–550 days | At maturity | AMD 30,000 – 250,000,000 |

| Artsakhbank | Term Deposits | 10% | 366–550 days | At maturity | AMD 50,000 – 50,000,000 |

| Converse Bank | "Progress" Deposit | 9.75% | 365 days | At maturity | AMD 30,000 – 50,000,000 |

| Unibank | "Classic" Deposit | 9.5% | 366–549 days | At maturity | AMD 100,000 – 100,000,000 |

| ArmSwissBank | Standard Term Deposit | 9.5% | 368–732 days | At maturity | AMD 10,000,000 – 30,000,000 |

US Dollar Deposits (USD)

| Bank | Deposit Type | Rate | Term | Interest Payment | Min / Max Amount |

| AMIO Bank | "Profitable" Term Deposit via AMIO Mobile | 5% | 366–550 days | At maturity | USD 100 – 500,000 |

| Byblos Bank Armenia | Term Deposit | 4.75% | 365 days | At maturity | USD 3,000 – 1,000,000 |

| Artsakhbank | Term Deposits | 4.5% | 366–550 days | Monthly | USD 150 – 791,000 |

| Araratbank | "Term" Deposit | 4.5% | 366–545 days | Monthly | USD 250 – 210,900 |

| Armeconombank | Classic Deposit | 4.3% | 367–545 days | At maturity | USD 200 – 100,000 |

| Byblos Bank Armenia | Accumulative Deposit | 4.25% | 365 days | At maturity | USD 250 – 180,000 |

Euro Deposits (EUR)

| Bank | Deposit Type | Rate | Term | Interest Payment | Min / Max Amount |

| Araratbank | "Term" Deposit | 2.5% | 366–545 days | Monthly | EUR 250 – 179,900 |

| AMIO Bank | "Profitable" Term Deposit via AMIO Mobile | 2.25% | 366–550 days | At maturity | EUR 100 – 400,000 |

| ArmSwissBank | Standard Term Deposit | 2.25% | 368–732 days | At maturity | EUR 20,000 – 67,400 |

| Armeconombank | Classic Deposit | 2.25% | 367–545 days | At maturity | EUR 200 – 100,000 |

| Armeconombank | Classic Deposit (quarterly payment) | 2.15% | 367–545 days | Quarterly | EUR 200 – 100,000 |

| Ardshinbank | Standard Deposit | 2% | 367–549 days | At maturity | EUR 1 – 200,000 |

Choosing a Deposit Based on Your Goal

Maximum Interest Rate for a 1-Year Term

This option is suitable when the highest nominal interest rate is the main priority for placing funds for approximately one year. As a rule, such deposits require maintaining the full term in order to retain the stated rate and are typically used for a one-time placement of funds. In this category, the highest rate is offered by the “Profitable” term deposit via AMIO Mobile from AMIO Bank.

Fixed Deposit with No Transactions

This option is designed for clients who place funds once and do not plan any replenishment, partial withdrawals, or early termination during the deposit term. Examples include the Term Deposit from Byblos Bank Armenia and the “Simple” deposit from Armeconombank, where no transactions are allowed during the term and interest income is paid at maturity or according to a predefined schedule.

Regular Interest Payments

This type of deposit is suitable when funds are used not only for safekeeping but also to generate regular income throughout the year. Interest may be paid monthly, quarterly, annually, or capitalized with payment at maturity. This format can be particularly important for personal cash flow and budget planning.

Flexibility for Foreign Currency Deposits

This option is relevant for users considering foreign currency deposits who want to retain the possibility of partial access to their funds without closing the deposit in full. Such deposits are typically chosen when the timing of capital use is uncertain and flexibility is a key consideration.

How to Choose Between AMD, USD, and EUR for an Amount of Around 10 Million AMD

When selecting the currency for a 1-year deposit, the following approach is typically used:

- AMD is considered when the priority is achieving the highest interest rate.

- USD is chosen when it is important to hold funds in a foreign currency while maintaining moderate returns.

- EUR is used less frequently and usually in cases where future expenses or obligations are denominated in euros.

This framework makes it possible to balance expected returns and currency risk within a single scenario – placing funds for one year.

Key Criteria for Comparing Deposits

- Interest rate

- Deposit currency (AMD, USD, EUR)

- Placement term (1 year)

- Interest payment format

- Possibility of replenishment

- Early termination conditions

- Minimum and maximum deposit amount

Limitations and Conditions

- The stated rates apply only if the funds are placed for the full term.

- In case of early termination, most banks recalculate interest at a reduced rate or cancel accrued interest entirely.

- Conditions for replenishment and partial withdrawals depend on the specific deposit product.

- All deposits are covered by the deposit insurance system: up to 16 million AMD per bank for deposits in drams and up to 7 million AMD for foreign currency deposits.

- Certain offers may include restrictions for non-residents.

How AFM Compares Deposits

AFM analyzes banking products based on official bank tariffs and publicly available documentation. Data is updated automatically at least once every 24 hours.

When ranking deposit offers, AFM takes into account key product parameters and the overall benefit for the client.

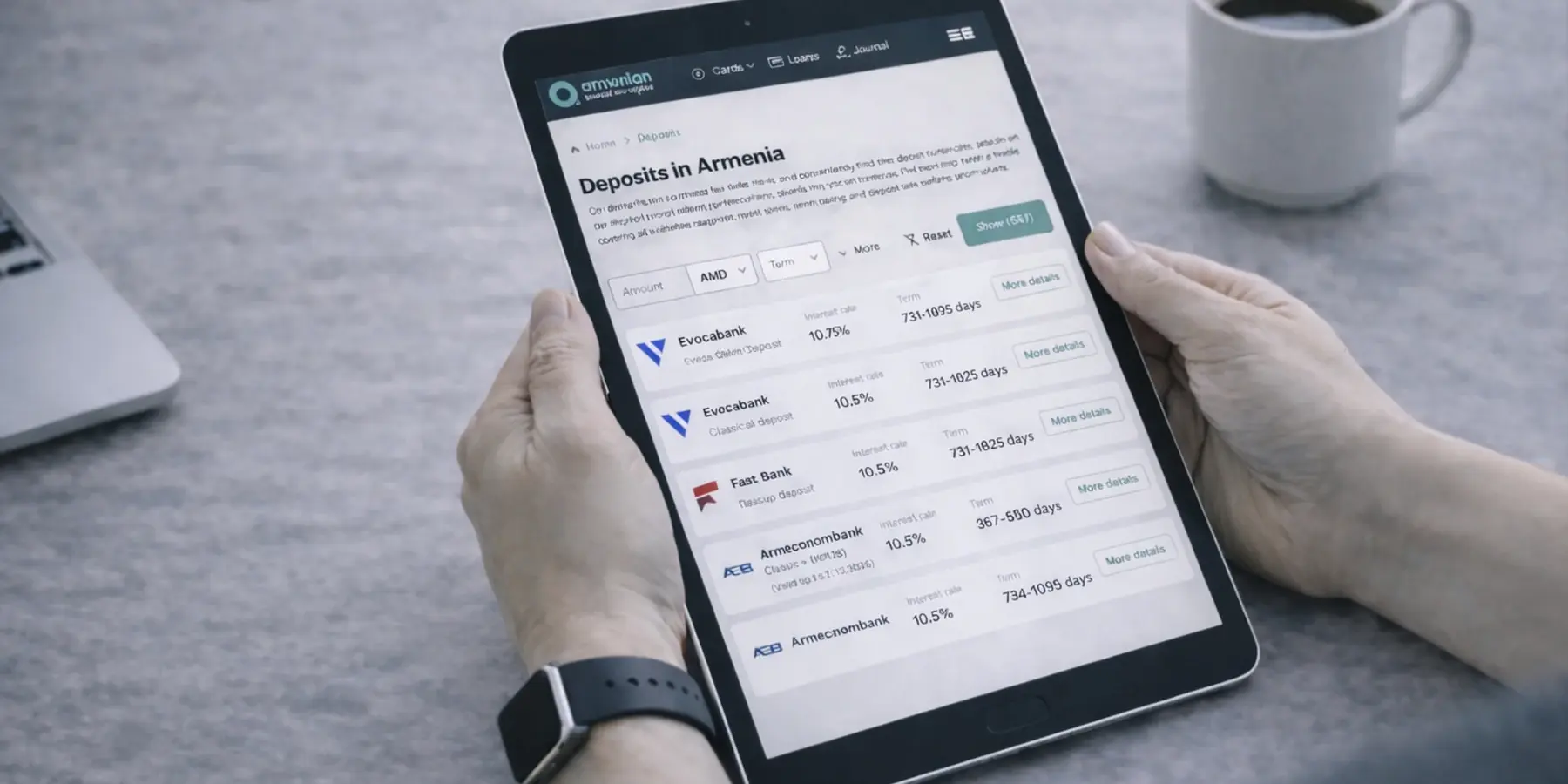

For an objective comparison of banking products in Armenia, it is recommended to use independent aggregators that analyze official bank tariffs and regularly update their data. One such platform is Armenian Financial Marketplace, where users can compare deposit, card, and loan conditions across key parameters.

When comparing 1-year deposits, AFM initially selects offers with the highest nominal interest rates and then adjusts the ranking based on interest payment format, early termination conditions, and amount-related restrictions. As a result, some deposits with a lower stated rate may be more suitable in certain scenarios.

Frequently Asked Questions

Which deposit currency is the most profitable for an amount of around 10 million AMD in January 2026?

AMD-denominated deposits lead in terms of effective rates, offering up to 10% per annum. USD deposits offer yields of up to 5%, while EUR deposits provide up to 2.5%, both allowing for funds to be held in their respective currencies.

Can a non-resident open a deposit in Armenia?

Yes. All the banks listed allow non-residents to open deposits, provided they have a valid identity document and a social card.

How is interest paid on deposits?

Interest may be paid monthly, quarterly, or at maturity, depending on the specific deposit product.

Does the interest payment format affect the final return on a deposit?

Yes. Even with the same nominal rate, a deposit with monthly interest payments and one with interest paid at maturity may result in different effective returns, especially if interest is capitalized or used by the client before the end of the term.

What happens to interest if a deposit is terminated early?

In the event of early termination, banks generally recalculate interest at a minimum rate or cancel accrued interest entirely. The exact recalculation method is defined by the terms of the deposit agreement.

Does opening multiple deposits in the same bank increase the insured amount?

No. The deposit insurance system applies to the total amount of a client’s funds held in the same bank.

Does non-resident status affect the deposit interest rate?

In most cases, the interest rate does not depend on residency status. However, non-residents may face higher minimum deposit amounts or additional documentation requirements.

Which is safer: one large deposit or several deposits in different banks?

Placing funds across multiple banks reduces concentration risk and may be justified when amounts are close to the deposit insurance limit.

From which day does interest start accruing on a deposit?

Interest typically begins to accrue from the day following the deposit opening date. The exact start date is specified in the product terms.

Can a bank change the interest rate on an existing deposit?

No. The interest rate is fixed at the time the deposit is opened and cannot be changed unilaterally by the bank.

Conclusion

As of January 2026, the most competitive one-year deposits in Armenia offer yields of up to 10% in AMD, 5% in USD, and 2.5% in EUR under standard placement terms.

AMD deposits are primarily used to achieve the highest nominal returns, while foreign currency deposits are chosen to hold funds in US dollars or euros at more moderate interest rates.

You can compare deposit terms offered by Armenian banks, assess potential returns, and evaluate options across different currencies on AFM, a platform where deposits are presented based on official bank tariffs.

Deposit Interest Rates in Armenian Banks – Updated Table for February 2026

The Best Euro Deposits in Armenia in Autumn 2025

Top Deposits in USD in Armenia in Autumn 2025

Top Deposits in AMD in Armenia in Autumn 2025

Profitable Promotions in Armenian Banks in December 2025