Make smart financial decisions!

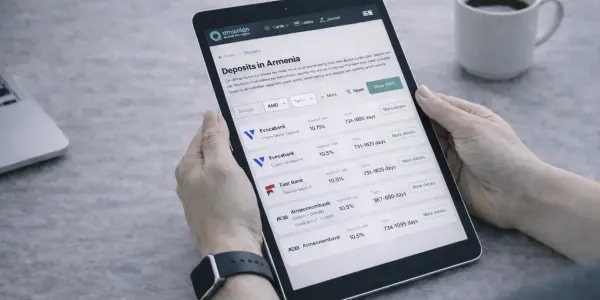

Find, compare, choose the most beneficial Armenian banking products - all in one place!

AFM is where your best financial decisions happen!

No more calling and visiting banks. We have collected everything in one place, and you just need to choose the best!

All of Armenia's financial products in one place. Find the best one for you.

Deposits

Check which banks offer the highest interest rates today

Mortgage

Find out which bank offers the most favorable terms

Credit cards

Consumer loans

Gold-backed loans

Debit cards

Student loans

News

Promotions

Current offers from banks in one place: additional cashback, discounts, free cards, and other conditions.

Banks in Armenia with the best exchange rates

Exchange rates

The most profitable options so far

Central Bank Rates

Currency converter

Why use AFM?

From the moment we meet, we will help you make the right financial decisions and save money.

Saving your time

All financial offers are gathered in one place, with a simple and user-friendly interface. Finding the best option takes just a few minutes — no need to browse multiple bank and credit organizations websites anymore.

It's all written in plain and simple language

Everything is explained in clear and simple language — even complicated banking terms. Whether you’re choosing insurance, a loan, or a mortgage through a government program, you can do it easily, even if it’s your first time.

We always show the full cost

Our top priority is to be genuinely helpful to our users. That’s why we clearly show any hidden terms in loans, deposits, and insurance offers — and always display the full cost. We also warn you in advance about any potential extra charges.

All banks

Journal

Open AFM journal

What Types of Loans Are Available in Armenia in 2026: Products, Rates, and Terms

Best Cash Loans in Armenia in 2026: Ranking by Effective Interest Rate

Which Armenian Banks are Easier for Non-Residents to Open an Account in 2026?

How the 2% ArCa Card Cashback Program Works in 2026

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

Currency Exchange at Zvartnots Airport: Where and How to Exchange Money After Arriving in Armenia

Financial news

All news

Digitalization of Armenia’s Banking Sector: AFM Research Findings Ahead of 2026

Armenia introduces crypto asset regulation starting January 31, 2026

Armenian Banks Increased Net Profit by 17% in 2025

VTB Armenia Launches MIR Travel Card for Transfers Between Russia and Armenia

AFM January 2026 Review: Changes in Bank Deposit Volumes in Armenia

Old second-generation banknotes will remain legal tender in Armenia until April 15, 2026

AFM is an independent financial marketplace that helps you choose the best banking products in Armenia. We analyze all bank offers, compare credit cards, deposits, mortgages, student loans, and premium banking services so you can find the most favorable terms.

Why Choose AFM?

- Transparency – No hidden fees, only current rates and conditions.

- Time-Saving – No need to browse multiple bank websites; everything is gathered in one place.

- Online Applications – Apply for a loan, card, or deposit without visiting a bank.

- Premium Banking Services – Exclusive privileges for high-net-worth clients.

Credit Cards – Up to 5% cashback, bonus programs, premium benefits, airport lounge access, free travel insurance, 24/7 concierge service, discounts at hotels and restaurants. Popular cards: Visa Infinite, Mastercard World Elite, ArCa Platinum.

Debit Cards – Free maintenance, high cash withdrawal limits, loyalty programs, convenient multi-currency accounts, favorable currency conversion rates, purchase protection. Popular cards: Visa Gold, Mastercard Standard, ArCa.

Loans Secured by Gold – Quick approval, low interest rates, flexible repayment terms, access to loans without income verification. A great option for those needing fast cash without bureaucracy.

Student Loans – Special terms for students at Armenian and international universities, deferred payments until graduation, low interest rates, full tuition financing.

Premium Banking Services – Dedicated relationship manager, exclusive deposit and loan rates, personalized investment solutions, higher credit limits, priority banking services.

Deposits – Best interest rates among Armenian banks, term and savings accounts, the ability to top up or withdraw funds without losing interest, multi-currency deposits, deposit insurance protection.

Mortgages – Government-supported programs, lower interest rates for young families and IT professionals, mortgages with no down payment, special deals for purchasing real estate from developers.

Investment Products – High-yield bonds, international deposits, real estate investments, and personalized capital investment strategies.

Loans, Credit Cards, Mortgages, and Deposits

-

Which bank offers the lowest interest rates on loans in Armenia?

Interest rates depend on the loan type and bank terms. On AFM, you can compare offers and choose the most favorable option.

-

What documents are required to apply for a loan?

A standard package includes a passport, proof of income, and in some cases, a credit history report and a guarantor.

-

Can I get a loan without proof of income?

Yes, some banks offer loans without income verification, but they often have higher interest rates or require collateral.

-

How do loans secured by gold work?

These loans don’t require income verification. You deposit gold jewelry, the bank evaluates its value, and you receive a loan based on the appraisal.

-

What types of credit cards are available in Armenia?

AFM allows you to compare standard credit cards (Visa Classic, Mastercard Standard), premium cards (Visa Infinite, Mastercard World Elite, ArCa Platinum), and cashback credit cards.

-

What is the difference between a debit card and a credit card?

A debit card allows you to spend your own money, while a credit card provides access to bank funds with an interest-free grace period.

-

Which bank offers the best cashback and bonus programs for credit cards?

Premium cards typically offer the best cashback deals. On AFM, you can compare cashback rates, bonus programs, and partner discounts.

-

Can I get a mortgage without a down payment?

Yes, some banks offer government-supported mortgage programs, where part of the down payment is subsidized.

-

What are the mortgage terms for young families in Armenia?

Mortgage programs for young families offer interest rates starting from 5%, subsidies, and extended repayment terms.

-

How can I get a mortgage for a newly built home?

When buying property from approved developers, banks often provide lower interest rates and simplified application processes.

-

Which deposits offer the best interest rates in Armenia?

On AFM, you can compare term, savings, and multi-currency deposits to find the most profitable options.

-

How does interest capitalization on deposits work?

Interest is added to the principal deposit amount, increasing earnings over time. This provides higher returns on long-term deposits.

-

Are bank deposits insured in Armenia?

Yes, Armenia has a deposit insurance system that guarantees the return of funds in case a bank fails.

-

What is the minimum deposit term in Armenian banks?

The minimum term is usually 1 to 3 months, but higher interest rates are available for longer deposits.

-

Can I open a deposit in US dollars or euros?

Yes, most banks offer multi-currency deposit options. Terms vary depending on the currency and deposit period.

-

What is AFM, and how is it different from banks?

AFM is not a bank but a financial marketplace that collects and compares all banking offers in Armenia to help customers find the best options.

-

How do I use AFM?

Simply choose a financial product (loan, deposit, mortgage, or card), compare bank offers, and apply online.

-

Why is AFM more convenient than going directly to a bank?

AFM provides all the real conditions upfront, including hidden fees, helping you select the most favorable offer without overpaying.

-

Can I apply for a financial product directly through AFM?

Yes, you can submit an online application for a loan, credit card, or deposit and receive approval from the bank.

-

Does AFM charge a fee for its services?

No, AFM is completely free for users. We operate as an independent financial aggregator, helping people compare and select banking products.

AFM is not a bank but your personal guide in the financial world. We analyze all banking offers so you can select the most profitable option.

Save time and money – no need to browse complex bank terms, we’ve already done the research for you.

Compare credit cards, loans, mortgages, and deposits today and make an informed financial decision.