Low-Interest Loans in Armenia: Which Banks Offer the Best Terms?

What Types of Loans Are Available in Armenia in 2026: Products, Rates, and Terms

Best Cash Loans in Armenia in 2026: Ranking by Effective Interest Rate

Which Armenian Banks are Easier for Non-Residents to Open an Account in 2026?

How the 2% ArCa Card Cashback Program Works in 2026

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

Currency Exchange at Zvartnots Airport: Where and How to Exchange Money After Arriving in Armenia

Sunday Towers: What You Need to Know Before Buying an Apartment

How to Open an Inecobank Card: A Complete Guide to Visa, Mastercard, and Virtual Cards

“1 Click” Online Loan from Inecobank: How to Apply in Just a Few Minutes Without Visiting a Branch

How Russian Citizens Can Open a Bank Card in Armenia in 2025: Is Remote Opening Possible?

Author

Roman GalstyanSource

AFMImage source

www.pexels.comTopic

Cash Loans, Secured Loans, Non-residents, ID Bank, Byblos Bank Armenia, Mellat Bank

Looking for low-interest loans with minimal rates? Many banks in Armenia offer loans, and at first glance, their terms may seem similar. However, in reality, they can vary significantly. In this review, we will analyze which banks provide the lowest interest rates, under what conditions you can get a cheaper loan, and how to choose the best offer in 2025.

When Does a Bank Offer a Low-Interest Loan?

Loan interest rates depend on many factors, and in certain situations, you can get a loan on more favorable terms. Let’s consider the seven main cases when a bank may lower the interest rate and offer better conditions, and how you can influence the rate yourself.

1. You Have a Good Credit History

Banks are more likely to approve loans for clients with a positive credit history. If you have previously repaid loans on time and your credit score is high (e.g., above 700 according to ACRA), your chances of getting a low-interest loan increase significantly.

Example: If your credit score exceeds 750, the bank may offer a rate 1-2% lower than the standard. You can check your credit history on the ACRA website.

To do this, follow these steps:

- Register on the My ACRA portal:

- Go to the ACRA website.

- In the top menu, select "Self Inquiry" and click "Register to My ACRA".

- Fill out the registration form, provide your personal details, and agree to the terms of use.

- Confirm and log in:

- After registration, you will receive a confirmation email.

- Click the link in the email to activate your account.

- Log in using your credentials.

- Request your credit report:

- In your account, select the option to request a credit report or FICO Score.

- Follow the instructions to complete the process (at this stage you will need the Viber app to complete the identification process).

You are entitled to a free full credit report on yourself from ACRA at least once every 12 months. However, there may be a charge for some reports, for example AMD 300-1400.

2. You Apply for a Loan in the Bank Where You Have a Salary Card

Some banks offer special rates to their existing customers. If you receive a salary or hold funds in a deposit account with a bank, you are more likely to get a preferential loan rate.

For example, if you have:

- A salary card in this bank – the rate may be reduced by 0.5-1%.

- A deposit or an account with a positive balance – this can increase your chances of getting a discounted rate.

Example: IDBank offers a 14% interest rate for salary cardholders instead of 17%.

3. You Take a Large Loan or Reduce the Loan Term

The larger the loan amount, the lower the rate, as the bank earns more profit. Also, choosing a shorter loan term reduces interest overpayment.

Example: If you take out a loan of 5 million AMD, the bank may lower the rate by 0.5-1%.

4. You Pledge Your Property

Besides standard consumer loans, there is another option—secured loans, which often come with lower interest rates. Since collateral reduces risks for the bank, it allows them to offer better terms.

If you have real estate, a car, or other valuable assets, you can get a secured loan at a lower rate. The higher the value and liquidity of the collateral, the better the loan conditions:

- The bank may lower the interest rate.

- More flexible repayment terms may be offered.

5. You Use Promotional Offers from Banks

Some banks temporarily reduce interest rates as part of various promotions, especially during holidays or product launches. Before taking out a loan, check current promotions—you may get a better rate right now.

For example:

- IDBank – reduced rate 14% for salary cardholders (until March 31, 2024).

- Byblos Bank Armenia – 0.5% discount on loans over 5 million AMD (until June 1, 2024).

6. You Use a Credit Card with a Grace Period

Another way to save on interest is to use a credit card with a grace period. Many banks offer cards that allow you to pay no interest at all if you repay the debt within the grace period (typically up to 30 days).

Important: If you miss the grace period deadline, interest is charged from the withdrawal date, which can increase the loan cost.

7. You Consider Refinancing

Refinancing allows you to replace an existing loan with a new one on better terms. This can lower your interest rate, reduce monthly payments, or change the loan term to make repayments more manageable.

In February 2025, the Central Bank of Armenia lowered the refinancing rate to 6.75%, which will lead to lower loan rates. This creates favorable conditions for borrowers with high-interest loans.

Several banks in Armenia offer refinancing options:

- IDBank: Offers mortgage-backed loans for refinancing existing obligations. The maximum loan amount is 125 million AMD, with an effective interest rate from 14.5%.

- AMIO Bank: Allows transferring an existing mortgage or consumer loan from another financial institution. The effective interest rate starts at 13.24%, with no issuance or service fees.

You can compare current refinancing conditions on our website.

Tip: You can also take out an unsecured consumer loan on better terms to pay off your existing loan.

Where to Get a Loan at the Lowest Interest Rate? Top 3 Banks with the Most Favorable Terms

Here are three banks offering the lowest interest rates on consumer loans:

| Bank | Min. Rate (%) | Max. Rate (%) | Min. Effective Rate (%) | Max. Effective Rate (%) | Min. Loan Amount (AMD) | Max. Loan Amount (AMD) |

| Byblos Bank Armenia | 14,5 | 14,5 | 15,41 | 15,63 | 400,000 | 10,000,000 |

| IDBank | 14 | 17 | 14,95 | 18,39 | 320,000 | 10,000,000 |

| Mellat Bank | 14 | 16 | 15,4 | 18,7 | 1,000,000 | 5,000,000 |

These banks offer the best loan rates with low-interest rates.

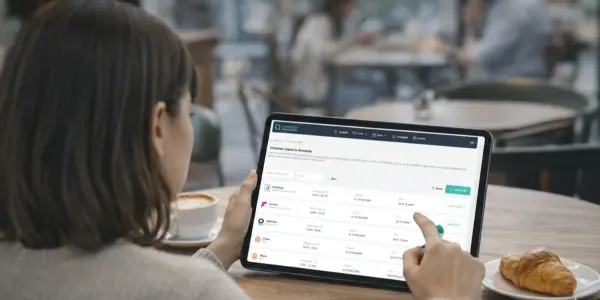

You can compare all current loan conditions in Armenia on our website. Simply go to the relevant section and select “interest rates” in the filters.

Conclusion

If you are looking for a low-interest loan, Byblos Bank Armenia, IDBank, and Mellat Bank currently offer the most favorable rates.

You can influence your loan interest rate! Improve your credit history, use a salary card at the same bank, opt for refinancing, or take a secured loan. Don’t forget to check for promotional offers!

If bank refinancing conditions don’t suit you, you can refinance your loan independently by choosing a better offer and closing your old loan. In 2025, the Central Bank of Armenia lowered the refinancing rate to 6.75%, making self-refinancing even more beneficial.

Compare bank offers and choose the best option on AFM—this will help you save time and money!

What Types of Loans Are Available in Armenia in 2026: Products, Rates, and Terms

Best Cash Loans in Armenia in 2026: Ranking by Effective Interest Rate

How to Get a Student Loan in Armenia: Banks, Terms, and Tips

What Is a Student Loan?

How to Properly Refinance a Loan to Save Money?