Euro Deposits in Armenia: Where to Find the Best Rates?

What Types of Loans Are Available in Armenia in 2026: Products, Rates, and Terms

Best Cash Loans in Armenia in 2026: Ranking by Effective Interest Rate

Which Armenian Banks are Easier for Non-Residents to Open an Account in 2026?

How the 2% ArCa Card Cashback Program Works in 2026

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

Currency Exchange at Zvartnots Airport: Where and How to Exchange Money After Arriving in Armenia

Sunday Towers: What You Need to Know Before Buying an Apartment

How to Open an Inecobank Card: A Complete Guide to Visa, Mastercard, and Virtual Cards

“1 Click” Online Loan from Inecobank: How to Apply in Just a Few Minutes Without Visiting a Branch

How Russian Citizens Can Open a Bank Card in Armenia in 2025: Is Remote Opening Possible?

Author

Saty AvagyanSource

AFMImage source

https://www.pexels.com/ru-ru/Topic

Deposits, ArmSwissBank, Byblos Bank Armenia, Evocabank, Armeconombank

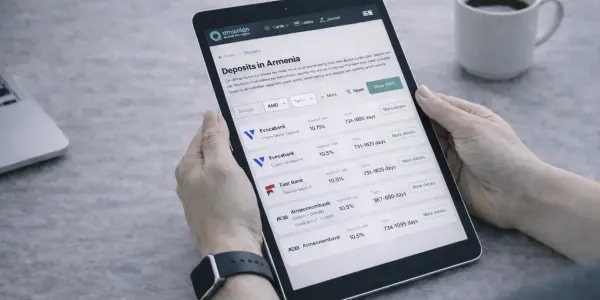

Foreign currency savings remain a relevant and strategic option in Armenia's banking market. AFM continues its series of overviews on foreign currency deposits — this time focusing on euro deposits. We reviewed offers from all 17 Armenian banks and selected the top 4 options based on interest rates, terms, and flexibility.

Top 4 Euro Deposits in Armenia for 2025

1. Evocabank – EVOCA Online

Key Terms:

| ParameterValue | |

| Term | 2–3 years |

| Minimum amount | €200 |

| Interest rate | 3.25% per annum |

| Account opening fee for non-residents | 10,000 AMD |

Special Features:

- The deposit is available exclusively online — via EvocaTOUCH and EvocaONLINE

- Can be replenished up to the original deposit amount

- No partial withdrawals allowed

- Early closure retains only part of accrued interest

- For terms longer than 1 year, the rate increases by 0.25%

2. Byblos Bank Armenia – Term Deposit

Key Terms:

| ParameterValue | |

| Term | 2 years |

| Minimum amount | €3,000 |

| Interest rate | 2.75% per annum |

| Minimum for foreign nationals | €30,000 |

Special Features:

- No replenishment or partial withdrawals allowed

- Early termination leads to recalculated interest

- Interest is paid only at the end of the term

3. Armeconombank – Classic Deposit

Key Terms:

| ParameterValue | |

| Term | 2–3 years |

| Minimum amount | €200 |

| Interest rate | 2.75% per annum |

Special Features:

- Replenishment allowed, but no partial withdrawals or early termination with full interest retention

- Interest paid at maturity only

- Comes with a free ArCa Classic card

- For deposits equivalent to 300,000 AMD, clients can choose a free Mastercard, Mastercard Gold, VISA Classic, or VISA Gold

4. ArmSwissBank – Standard Term Deposit

Key Terms:

| ParameterValue | |

| Term | 2–3 years |

| Minimum amount | €20,000 |

| Interest rate | 2.75% per annum |

Special Features:

- No replenishment or partial withdrawals allowed

- Interest recalculated if closed early

- Only service available to new clients

- To access other services, the client must first open a deposit

Conclusion

If you're looking for the most profitable euro deposit, Evocabank stands out with the highest rate and the most flexible conditions — online setup, top-up options, and a bonus rate for longer terms.

Byblos Bank Armenia, Armeconombank, and ArmSwissBank follow closely behind with the same interest rate of 2.75%, but they differ in minimum deposit amounts, accessibility for foreign nationals, and additional benefits.

Want to compare euro or multi-currency deposits? Use AFM’s smart comparison tools and find the offer that truly works for your financial goals.

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

The Best Euro Deposits in Armenia in Autumn 2025

Top Deposits in USD in Armenia in Autumn 2025

Top Deposits in AMD in Armenia in Autumn 2025

Profitable Promotions in Armenian Banks in December 2025