Top 5 deposit offers in Armenia for non-Residents

What Types of Loans Are Available in Armenia in 2026: Products, Rates, and Terms

Best Cash Loans in Armenia in 2026: Ranking by Effective Interest Rate

Which Armenian Banks are Easier for Non-Residents to Open an Account in 2026?

How the 2% ArCa Card Cashback Program Works in 2026

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

Currency Exchange at Zvartnots Airport: Where and How to Exchange Money After Arriving in Armenia

Sunday Towers: What You Need to Know Before Buying an Apartment

How to Open an Inecobank Card: A Complete Guide to Visa, Mastercard, and Virtual Cards

“1 Click” Online Loan from Inecobank: How to Apply in Just a Few Minutes Without Visiting a Branch

How Russian Citizens Can Open a Bank Card in Armenia in 2025: Is Remote Opening Possible?

Author

Roman GalstyanSource

AFMImage source

AFM: Chat GPTTopic

Deposits, AMIO Bank, Artsakhbank, Byblos Bank Armenia, Evocabank

What is required for non-residents to open a deposit in Armenia?

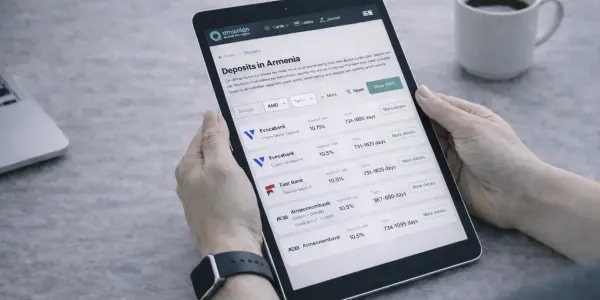

We have researched this question and selected the five most advantageous deposit accounts in Armenia available to non-residents.

Let’s imagine you have 2 million AMD and would like to deposit it in a bank for one year. You can do this at any of Armenia’s 17 banks. However, not all of them offer favorable or flexible terms.

AFM is a platform that monitors Armenia’s financial market and provides up-to-date, detailed information about the country’s banking products.

Use our deposit selection tool to filter and find the most suitable and profitable option for your needs.

So, let’s take a look at which banks offer the best conditions for opening a deposit if you are a non-resident.

AMIO Bank – “Profitable” Deposit via AMIO Mobile

Interest rate: 10.25% per annum.

Capitalization: none.

Top-ups, partial or early withdrawals: not allowed.

Fees: 15,000 AMD annual account maintenance fee for non-residents.

Required documents: ID card, social card, proof of income.

Advantages: highest interest rate currently available free Visa or Mastercard.

Disadvantages: can only be opened via the bank’s mobile app, i.e., available to existing clients only.

Your annual income from the deposit:

2,000,000 * 10.25% = 205,000

Tax (10%) = 20,500

Fee = 15,000

Net income: 169,500 AMD

AMIO Bank – “Profitable” Deposit (for New Clients)

Interest rate: 10% per annum.

Capitalization: none.

Top-ups, partial or early withdrawals: not allowed.

Fees: 15,000 AMD annual account maintenance fee for non-residents.

Required documents: ID card, social card, proof of income.

Advantages: available to new clients.

Disadvantages: early termination forfeits interest.

Your annual income from the deposit:

2,000,000 * 10% = 200,000

Tax (10%) = 20,000

Fee = 15,000

Net income: 165,000 AMD

Artsakhbank – “Term Deposits”

Interest rate: 10% per annum.

Capitalization: none.

Top-ups: not allowed.

Partial withdrawals: allowed up to 20%.

Early termination: allowed, but with only 1% interest paid.

Fees: 10,000 AMD account opening + 300 AMD per quarter (1,200 AMD/year) for non-residents.

Required documents: ID card, social card.

Advantages: high interest rate, partial withdrawal allowed.

Disadvantages: no capitalization or top-ups allowed.

Your annual income from the deposit:

2,000,000 * 10% = 200,000

Tax (10%) = 20,000

Fee = 10,000 + 1,200 = 11,200

Net income: 168,800 AMD

Evocabank – “Symphonic” Deposit

Interest rate: 9.75% per annum.

Capitalization: none.

Top-ups: allowed.

Partial withdrawals: not allowed.

Early termination: allowed with partial interest retention.

Fees: 10,000 AMD annual account fee for non-residents + mandatory 0.25% donation from earned interest to the Armenian Symphony Orchestra.

Required documents: ID card, social card, proof of income.

Advantages: ability to top up the deposit.

Disadvantages: part of the income is donated to charity.

Your annual income from the deposit:

2,000,000 * 9.75% = 195,000

Tax (10%) = 19,500

Fee = 10,000

Mandatory donation (0.25%) = 488

Net income: 165,012 AMD

Byblos Bank Armenia – “Term Deposit”

Interest rate: 9.75% per annum.

Capitalization: none.

Top-ups, partial or early withdrawals: тot allowed.

Fees: 5,000 AMD account opening + 200 AMD monthly (2,400 AMD/year) for non-residents.

Required documents: ID card, social card.

Advantages: simple terms.

Disadvantages: minimum deposit amount: $30,000 or equivalent in another currency.

Your annual income from the deposit:

2,000,000 * 9.75% = 195,000

Tax (10%) = 19,500

Fee = 5,000 + 2,400 = 7,400

Net income: 168,100 AMD

Final Ranking by Net Income

| Bank | Interest кate | Net фnnual шncome (in AMD) | Highlights |

| AMIO Bank | 10,25% | 169,500 | Highest interest rate |

| Artsakhbank | 10% | 168,800 | Option for partial withdrawal |

| Byblos Bank Armenia | 9,75% | 168,100 | Fixed conditions |

| Evocabank | 9,75% | 165,012 | Contribution to symphony orchestra fund |

| AMIO Bank | 10% | 165,000 | Simple conditions |

Now you are informed about the top 5 deposit accounts in Armenia available to non-residents for a 1-year term.

Use the AFM platform to ensure your financial decisions always work in your favor.

The Most Profitable Bank Deposits in Armenia in AMD, USD, and EUR – January 2026

The Best Euro Deposits in Armenia in Autumn 2025

Top Deposits in USD in Armenia in Autumn 2025

Top Deposits in AMD in Armenia in Autumn 2025

Profitable Promotions in Armenian Banks in December 2025